The Gator oscillator is a technical indicator used in foreign exchange markets to help traders analyze trends and confirm signals. This unique indicator was created in 2002 by forex analyst Bill Williams and provides a visual representation of the degree of convergence between two moving averages.

The Gator oscillator can be a valuable tool for traders looking to determine trend strength, spot potential reversals, and time entries and exits. In this comprehensive guide, we’ll explain what the Gator oscillator is, how it is calculated, and most importantly – how to use it effectively in a trading strategy.

What is the Gator Oscillator?

The Gator oscillator consists of two lines that represent the balance between short and long-term market momentum. The lines are:

- Upper Gator Jaw – This blue line is a 13-period SMMA (Smoothed Moving Average) of the midprice (average of the high and low)

- Lower Gator Jaw – This red line is an 8-period SMMA of the midprice

The area between the two jaws is shaded light blue and known as the Gator Teeth. When the jaws are tightly closed with little separation, the Gator is considered to be “sleeping”. As the jaws expand away from each other, the Gator is said to be “eating”.

The distance between the Jaws represents converging or diverging moving averages. When the averages move close together, it signals a period of consolidation. When they move far apart, it flags a strong trend.

By visualizing the interaction between these two moving averages, the Gator helps traders confirm the strength of a trend and spot potential reversals early. Let’s look further at how the indicator is calculated.

How is the Gator Oscillator Calculated?

The Gator oscillator is derived from two smoothed moving averages of the midprice. Here are the key steps:

- Calculate the Midprice: (High + Low) / 2

- Calculate a 13-period SMMA of the Midprice

- This produces the Upper Gator Jaw

- Calculate an 8-period SMMA of the Midprice

- This produces the Lower Gator Jaw

- Shade the area between the Jaws light blue (Gator Teeth)

The SMMA (Smoothed Moving Average) is used rather than a simple moving average because it provides a smoother line that is slower to react to price changes. This helps filter out market noise and keep traders focused on the broader trend.

Note: The default periods used are 13 and 8. However, traders can adjust these periods to suit their timeframe and goals. Shorter periods will make the Gator more reactive while longer periods will smooth it out.

Now let’s see how the Gator appears visually on a chart…

How to Interpret the Gator Oscillator

When the Gator oscillator is added to a price chart, it appears in a separate window below the main price action. Here is an example:

There are three key things to observe:

- Crossovers – When the blue and red lines cross, it signals a change in momentum. We’ll discuss strategies around trading crossovers shortly.

- Convergence/Divergence – When the lines move close together the Gator is “sleeping”. This signals consolidation before a breakout. When the lines separate, the Gator is “eating” showing a strong established trend.

- The Gator Teeth – The shaded area between the jaws represents indecision and volatility between the averages. Widening teeth signal momentum is building in the direction of the broader move.

Now let’s break down some specific trading tactics using these patterns.

How to Trade Using the Gator Oscillator

The Gator oscillator was designed specifically for trend trading. It helps traders confirm solid trends, time entries, anticipate reversals early, set profit targets, and more. Here are some of the most common ways to trade with the Gator:

Confirm Trend Direction

When the Gator oscillator lines are far apart and expanding, it confirms an active trend is in motion. Traders can then look for buying or selling opportunities in the direction of that trend.

For example, when the Upper Jaw is well above the Lower Jaw and diverging further, it confirms an uptrend. The opposite is true for a downtrend.

By confirming the trend with the Gator first, traders are at less risk of trading counter-trend on pullbacks and minor reversals.

Time Entries

The distance between the Jaws also gives signals on when to enter a trade. During a strong trend, you generally want to see widening Gator Teeth with the lines diverging. This shows momentum is building in that direction.

Waiting for the Teeth to widen reduces the chance of entering prematurely before a breakout. Analyzing the momentum wave with the Gator improves timing.

Gauge Reversal Signals

When the Gator lines begin converging and moving closer together, it indicates the trend is potentially exhausting itself. Tighter Jaws reflect decreasing momentum and range contraction.

Watch for the lines to cross shortly after convergence. The crossover marks a reversal point. This signals an opportunity to exit a current trade or enter a reversal position.

Set Profit Targets

Traders can also use the Gator jaws to set profit targets for trades. A logical target is the next time the oscillator lines converge and cross.

This signals the trend will likely stall and reverse at that point. Taking partial or full profits as the lines come together ensures you exit before momentum turns.

Trading Examples

Now let’s see examples of how to implement Gator oscillator strategies:

Confirming Trend

- When the Gator jaws separated and began diverging in early September, it signaled an uptrend was forming.

- This was a clue to buy around $1.17 with an initial stop below the Gator Teeth.

- As the uptrend extended, the expanding Jaws reflected building momentum to the upside.

Timing Entry

- In mid-October, the Gator Teeth widened after a period of consolidation. This reflected momentum building to the upside.

- Entering around $1.15 with the Teeth expansion confirmed good timing before the strong breakout.

Crossover Reversal

- As the Gator lines converged in mid-Nov, it signaled the uptrend was weakening and likely to reverse soon.

- The crossover in late November confirmed the reversal. This prompted an exit around $1.28.

- The entry and exit based on the Gator oscillator produced a healthy profit in this trade.

Profit Target

- This downtrend had widened Gator Teeth reflecting strong bearish momentum.

- A logical profit target was the next time the Jaws converged and crossed at the end of October.

- Taking profits at $1.10 locked in most of the downtrend before the reversal occurred.

These examples demonstrate how the Gator oscillator can precisely time trades and maximize profits from trends. Let’s now look at some specific trading strategies that utilize the Gator.

Gator Oscillator Trading Strategies

Here are some of the most effective trading strategies using the unique signals of the Gator indicator:

Gator Breakout Strategy

This strategy enters breakouts in the direction of the Gator trend:

- Confirm an uptrend or downtrend with widened Gator jaws

- Wait for a brief pullback to a support/resistance level in that trend direction

- Enter a breakout trade when price breaks the high/low of the pullback

- Set a stop loss below the latest swing pivot low for buys, or above the pivot high for sells

- Target the next Gator crossover for profit taking

- Trail stops to lock in gains as the trend extends

Gator Reversal Strategy

This strategy trades Gator crossover signals that mark reversals:

- Identify convergence and potential crossovers on the Gator oscillator

- Wait for the lines to cross and confirm a reversal

- Enter a trade in the direction of the new trend shortly after the crossover

- Set a stop loss on the other side of the Gator teeth to limit risk in case it’s a false signal

- Target momentum rallies after reversals by trailing stops

Gator Channels Strategy

This strategy enters on bounces between Gator jaws:

- Identify periods when Gator lines are oscillating in a channel

- Buy near the lower jaw when it is support, sell near the upper jaw when it is resistance

- Size positions smaller since trades counter to the main trend

- Take quick profits on bounces back to the midpoint or jaws

Gator RSI Divergence Strategy

This strategy combines Gator signals with RSI divergence:

- Look for divergence between Gator jaws and RSI (e.g. Gator rising and RSI falling)

- Identify expanding Gator teeth with RSI diverging below 30 / above 70

- Enter trades when the RSI divergences signal exhaustion (RSI crosses back above / below 70/30)

- Can apply to both trends and ranges for smart counter-trend entries

These are just a few examples of strategies traders have crafted over the years using the adaptive Gator oscillator. The key is staying flexible and letting the indicator guide your trading plan.

Tips for Effectively Trading with the Gator Oscillator

Here are some tips to use the Gator oscillator effectively:

- Use on higher timeframes (4H, daily, weekly) for reliable trading signals

- Combine with other indicators like moving averages to confirm trading signals

- Adjust the Jaw periods to optimize for market conditions and timeframes

- Be patient for high-probability breakout and reversal signals

- Consider both directional fades and breakout strategies

- Use proper risk management with stops to limit losses on wrong signals

- Trail stops or take partial profits to ride out extended trends

With the right trading approach, the Gator can lead to very favorable risk-reward outcomes. Now let’s explore how to add this powerful indicator to your charts.

How to Add the Gator Oscillator to Charts

The Gator oscillator is available on most trading platforms as a standard indicator. Here are instructions for adding it on popular charts:

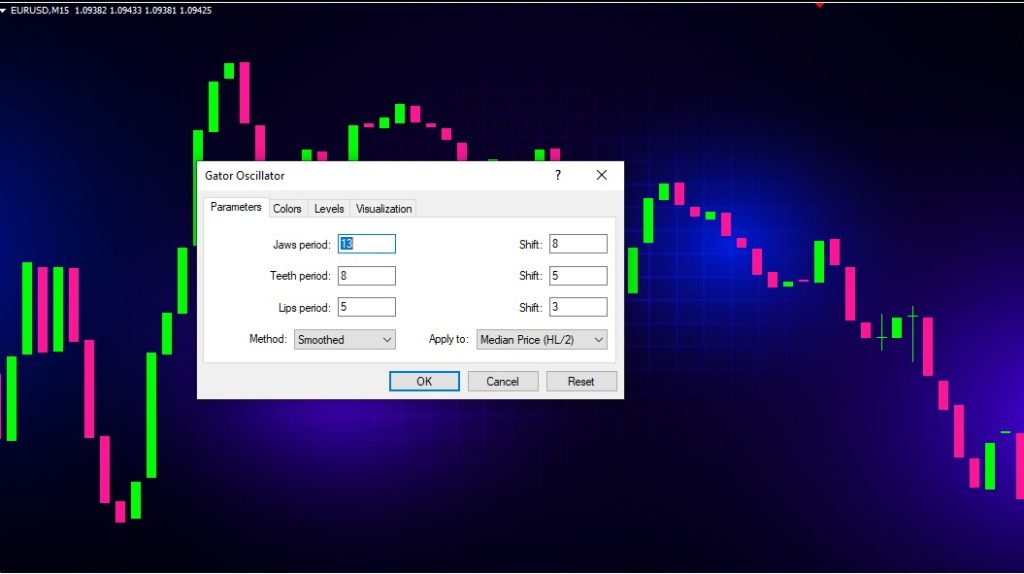

MetaTrader 4

- Open an FX pair and timeframe of choice

- Select Indicators in the Navigator window

- Type “Gator” in the search box

- Double click on Gator Oscillator or drag it onto the price chart

TradingView

- At the top of the Charts tab, click on Indicators

- Search for “Gator”

- Select Gator Oscillator by LazyBear

- Adjust the settings and click Add to Chart

NinjaTrader

- From the Indicators menu select Bill Williams and Add Gator Oscillator

- Click on System Analyzer and drag Gator Oscillator onto a chart

- Adjust periods as desired and click Apply Changes

The default jaw periods are 13/8 but traders can set these based on personal preferences and what works well in the current market conditions.

The Bottom Line

The Gator oscillator is a unique technical indicator that visualizes the interaction of short and long-term trends. By depicting the balance of power between competing moving averages, the Gator provides effective signals for trading trends, reversals, breakouts, and corrections.

While not infallible, the insights from Gator can significantly improve trading results when used properly. Traders should integrate Gator analysis with a structured plan that accounts for risk management, sound money management, and proper position sizing.

By combining the adaptive signals of the Gator with wise trading principles, investors can boost performance and expand profits from forex markets. The visual tools of the Gator oscillator help cut through market noise and distill actionable trading signals from raw price data.

Overall, the Gator is an invaluable tool in the forex trader’s toolbox. Learn to unleash it’s capabilities and this unique indicator will contribute tremendously to lasting trading success.