The Alligator indicator is a fascinating technical analysis tool used by forex traders to identify emerging trends, provide trade signals, and smooth market noise. This unique indicator was developed in the 1990s by American trader Bill Williams and remains an extremely useful instrument in a trader’s toolbox.

In this comprehensive guide, we will cover everything you need to know about the Alligator indicator – how it is constructed, how to interpret the signals, when to use it, and effective trading strategies. Whether you are a novice trader looking to learn or an experienced trader hoping to sharpen your skills, read on to unlock the power of this “reptilian” indicator.

What is the Alligator Indicator?

The Alligator indicator is a combination of balance lines (Moving Averages) that forms patterns resembling an alligator’s open and closed mouth. The name comes from how the various lines appear on the chart – the Alligator’s jaw is considered open when the lines are apart, indicating a strongly trending market. When the lines are closed together, the Alligator’s mouth is closed, signaling a range-bound market.

This indicator aims to help traders determine trend direction, provide trade signals, and filter market noise. It contains 3 key components:

- Alligator Jaw (Blue Line) – 13-period Moving Average, shifted 8 bars into the future

- Alligator Teeth (Red Line) – 8-period Moving Average, shifted 5 bars into the future

- Alligator Lips (Green Line) – 5-period Moving Average, shifted 3 bars into the future

These three balance lines are essentially EMAs (Exponential Moving Averages) shifted into the future and then smoothed. When plotted on a chart, they appear as three twisting lines resembling the mouth of an alligator waiting to devour its prey.

How is the Alligator Indicator Calculated?

Let’s break down precisely how each line of the Alligator is calculated:

Alligator Jaw (Blue)

This is a 13-period Exponential Moving Average, shifted 8 bars into the future.

- 13 periods is used to smooth out short-term market noise.

- The shift forward “looks” ahead and aims to define the long-term trend.

Alligator Teeth (Red)

This is an 8-period EMA, shifted 5 bars forward.

- The shorter period aims to capture the medium-term market dynamic.

- The shift smooths the line and prevents false signals.

Alligator Lips (Green)

This is a 5-period EMA shifted 3 bars forward.

- The very short period captures the immediate market price action.

- The small shift allows sensitive analysis of trend changes.

The three EMAs are smoothed using Wilder’s Smoothing Method to filter noise before shifting forward. This produces the three twisted balance lines that make up the Alligator indicator.

Alligator Chart Patterns

The interaction of the three Alligator lines produces identifiable chart patterns that provide traders with valuable information. The distinct signals are:

Open Alligator Mouth

When the three EMA lines are separated with the Lips (Green) on bottom, Teeth (Red) in middle, and Jaw (Blue) on top, this signals a strong uptrend. The Alligator’s mouth is open wide, ready to continue devouring prey.

Closed Alligator Mouth

When the three EMA lines converge very closely together, with the Lips (Green) on top, this indicates a range-bound market. The Alligator’s mouth is closed as it rests before the next trending period.

Opposing Alligator Signals

If the Lips and Teeth EMAs cross in opposing directions, this serves as an early signal that the current trend may reverse. For example, if the Lips cross up through the Teeth line, be alert for a downtrend.

Breakouts

When the price breaks out of the Alligator’s mouth, meaning it crosses above the upper Blue line or lower Green line, this often signals continuation of the emerging trend.

These patterns provide a visual map to better understand the state of the current market – whether it is trending, reversing, or range-bound.

How to Trade Using the Alligator Indicator

Now that we understand how the Alligator is structured and what chart patterns to look for, let’s examine how to actually trade using the Alligator signals.

Long Trades

When the Alligator lines are separated with Blue on top and Green on bottom, this signals an uptrend. Look to buy when:

- Price breaks above the upper Blue line as the trend gains momentum

- The three lines are fully separated showing strong bullish sentiment

- The lines begin to converge signaling the uptrend may be ending soon

Set a stop loss below the Alligator’s mouth or just below the recent swing low. Book profit once momentum shifts downward as seen by the converging EMA lines.

Short Trades

When the Alligator lines are separated with Green on top and Blue on bottom, this signals a downtrend. Look to sell short when:

- Price breaks below the lower Green line as bearish momentum accelerates

- The three lines are fully separated showing solid bearish strength

- The lines begin to converge indicating the downtrend may be ending

Set a stop loss just above the Alligator’s mouth or the recent swing high. Take profit as downward momentum wanes when the EMA lines converge.

Range-Bound Market

When the Alligator lines are twisted together with minimal separation, the market is likely range-bound. Assess momentum using other indicators to determine breakout direction.

- Trade the upper and lower boundaries of the range

- Use tighter stops to capitalize on short-term movements

- Avoid trading during low volatility consolidation periods

Additional Confirmation

Consider combining the Alligator with an additional indicator like MACD or Stochastics for higher probability setups. This provides further confirmation of emerging trends and consolidation.

For example, if the Alligator signals an uptrend AND the MACD histogram crosses into positive territory, this helps confirm your long entry. Use multiple indicators to properly gauge market momentum.

Alligator Trading System Rules

Here are the key rules to follow when using the Alligator system:

- Trade in direction of open Alligator mouth – Long above Blue line, Short below Green

- Confirm signals with break of Alligator’s lips/jaw (price breakout)

- Use other indicators like MACD for additional trend confirmation

- Define range-bound market when lines are twisted together

- Scale out of trades as momentum shifts (EMA convergence)

- Set stop loss just outside the Alligator’s mouth

- Avoid trading during low volatility periods where lines are flat

Following these guidelines when analyzing the Alligator on your charts will put you in higher probability trades aligned with the developing trend.

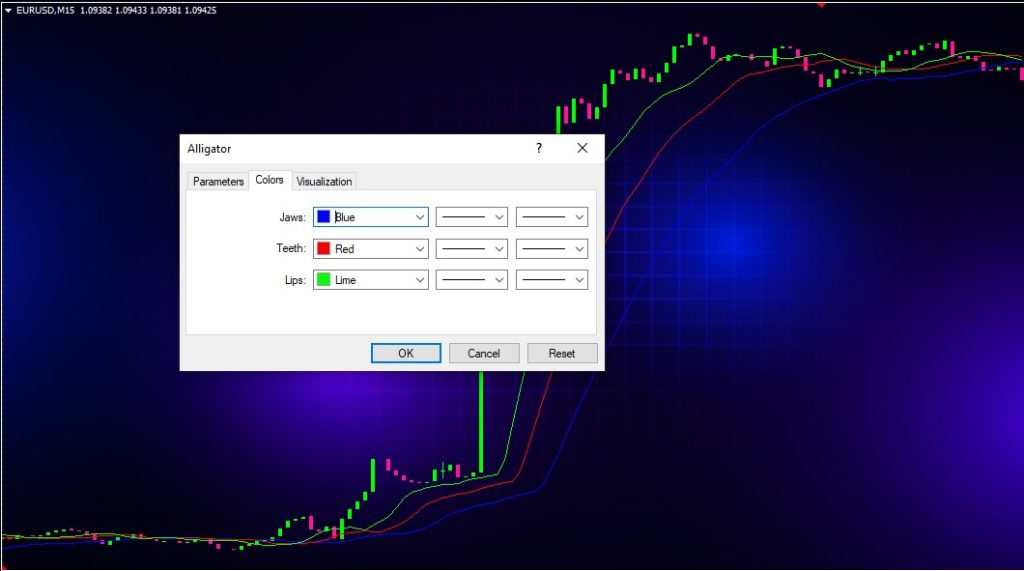

Alligator Indicator Settings

The standard setting for the Alligator indicator across all timeframes is:

- Jaw Period: 13, Shift: 8

- Teeth Period: 8, Shift: 5

- Lips Period: 5, Shift: 3

Wilder’s MA smoothing is standard. The Jaw is set to Blue, Teeth to Red, and Lips to Green.

You can experiment with the Alligator periods and shift values to better match your trading style. For example, decreasing the period lengths will make the indicator more sensitive. Too much sensitivity may lead to false signals however.

The standard settings aim to balance trend identification over the most recent 13-8-5 periods with responsiveness and future look-ahead ability.

Alligator vs. Moving Averages

The Alligator indicator builds upon moving averages but offers distinct advantages:

- Lookahead ability – The forward shifts allow you to visualize potential momentum

- Noise filtering – Wilder’s smoothing filters erratic price action

- Clear signals – The lines and colors make trends easy to identify

- Sensitive reaction – Shorter averaging periods capture trend changes faster

Traders who rely solely on basic moving averages can upgrade to the Alligator for more robust trend-confirmation and trade signals specific to forex trading.

Benefits of Using the Alligator Indicator

Here are the primary advantages traders can realize using the Alligator indicator:

- Visual representation – The Alligator gives clear visual signals on a chart

- Trend identification – Alerts traders to emerging and mature trends early

- Confirmation tool – Validates trend direction when used with other indicators

- Smooths noise – Filters erratic price moves unrelated to overall trend

- Signals trading opportunities – Provides high-probability entry and exit levels

- Adaptable – Settings can be adjusted to suit analytical needs

- Leading indicator – The forward shifts allow an ability to forecast

- Easy to interpret – No complex calculation required to read signals

The Alligator offers an intelligent combination of trend and momentum analysis in a simple, visual package. William’s novel indicator remains extremely useful to forex traders today.

Limitations of the Alligator Indicator

While the Alligator is an excellent trend-following tool, traders should be aware of a few limitations:

- Lagging – Smoothed moving averages have inherent lag which can delay signals

- Late exit – Lines converge late so exit timing is not precise

- Range-bound weaknesses – Signals are less reliable in choppy or ranging markets

- False signals – Crossovers can trigger premature entry/exit

- Repainting – Common in all indicators since data is finite

- Subjectivity – No definitive way to interpret every price pattern

- Optimization flaws – Can be overfitted to historical data

Combining the Alligator with pure price action techniques and other indicators helps overcome these limitations. Use the signals to confirm your market bias, but consider additional factors in your overall trading plan.

Alligator Trading Strategy Examples

Let’s look at two examples of effective trading strategies using the Alligator:

Breakout Strategy

This straightforward strategy looks to enter trend continuations when price breaks out of the Alligator’s mouth. When the EMA lines are separated signaling a trend:

- Buy when price breaks above the Blue upper line

- Sell when price breaks below the Green lower line

The breakout confirms the emerging trend. Place stops outside the Alligator’s mouth and target an equivalent 2:1 or 3:1 risk-reward ratio.

Range Fade Strategy

This counter-trend strategy fades the edges of a range when the Alligator lines are twisted together:

- Sell near upper range boundary, targeting lower support zone

- Buy near lower range boundary, targeting upper resistance level

Use additional indicators like MACD to confirm range-bound conditions. The Alligator identifies consolidation while other tools pinpoint imminent breakouts.

Alligator vs. Other Forex Indicators

How does the Alligator compare to other popular indicators for forex trading?

Moving Averages – More advanced with additional smoothing and shifts

Bollinger Bands – Alligator more clearly signals trends and reversals

MACD – Alligator simpler with visual signals; MACD better for momentum gauge

RSI – Alligator more effective for trend-trading; RSI better for overbought/oversold

Ichimoku Cloud – Both aim to identify trends and reversals early

The Alligator was designed specifically for trend trading, an essential component of forex trading. While other indicators have strengths in momentum, volatility, or reversals, the Alligator stands out in its balance of trend identification and filtration.

Alligator Indicator – Final Thoughts

The Alligator indicator remains an extremely beneficial tool for forex traders to identify emerging trends, provide trade signals, and smooth market noise. The unique design based on shifted moving averages offers traders a “predictive” glimpse into potential price momentum.

Learning to interpret the signals takes practice, but the visual patterns are intuitive compared to more opaque indicators. Combining with pure price action context and other indicators provides reliable confirmation.

As with any trading tool, the Alligator has limitations so should not be used in isolation. But when integrated properly as part of a holistic trading plan, the Alligator offers excellent trend guidance.

So don’t be afraid to unleash this reptilian indicator on your forex charts. With the Alligator on your side, you can devour the forex markets with powerful trend-trading accuracy.