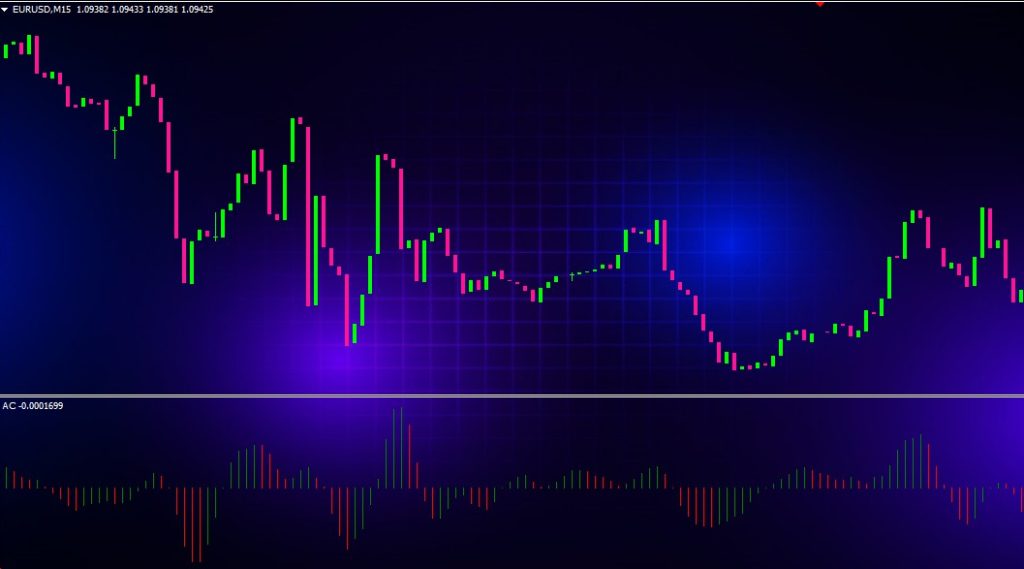

The accelerator oscillator is a technical analysis indicator used by forex traders to identify overbought and oversold conditions in the market. This oscillator, sometimes referred to as AC, utilizes the rate of change between the current price and a moving average of the price to generate trading signals.

In this comprehensive guide, we will cover everything you need to know about using the accelerator oscillator indicator when trading forex. We’ll discuss what the indicator is, how it is calculated, how to interpret the signals, recommended trading strategies, and the advantages and limitations of this tool. By the end, you’ll have a solid understanding of how to effectively utilize the accelerator oscillator in your trading.

What is the Accelerator Oscillator?

The accelerator oscillator is a momentum oscillator developed in 1973 by Bill Williams, a pioneer in the field of trading psychology and technical analysis. The main function of the indicator is to identify overbought and oversold conditions in the market.

How the Accelerator Oscillator is Calculated

The accelerator oscillator is calculated based on two moving averages of the price:

- A shorter period moving average (typically 5 periods)

- A longer period moving average (typically 34 periods)

The formula is:

Accelerator Oscillator = (Shorter MA – Longer MA) / Shorter MA x 100

So the indicator takes the difference between a fast and slow moving average, divided by the fast moving average. This results in an oscillator that fluctuates above and below zero.

Most charting platforms will do this calculation automatically once the periods are set. But it’s helpful to understand what’s happening under the hood.

Accelerator Oscillator Signals

When the oscillator moves above zero, this signals increasing momentum and suggests the market may be overbought. When it falls below zero, momentum is decreasing and the market may be oversold.

Overbought Conditions

An overbought reading occurs when the oscillator rises above the zero line. This suggests upside momentum is increasing at an accelerated rate and indicates a potential reversal to the downside may be near.

Traders will watch for the following sell signals when the oscillator is overbought:

- The oscillator crosses back BELOW the zero line – momentum has shifted from positive to negative

- The oscillator forms lower highs as price continues rising – bearish divergence

- The oscillator crosses its upper signal line – indicates strong upside momentum

Oversold Conditions

An oversold reading occurs when the oscillator falls below the zero line. This suggests downside momentum is increasing rapidly and the market may be ready for a bounce higher.

When the oscillator is oversold, traders will watch for the following buy signals:

- The oscillator crosses back ABOVE the zero line – momentum has shifted from negative to positive

- The oscillator forms higher lows as price continues falling – bullish divergence

- The oscillator crosses its lower signal line – indicates strong downside momentum

Accelerator Oscillator Trading Strategies

Now that we understand the basic overbought and oversold signals, let’s review some trading strategies to utilize with the accelerator oscillator.

Zero Line Crossovers

One of the most straightforward strategies is to buy when the oscillator crosses above zero and sell when it crosses below zero. This signals a shift in momentum – from bullish to bearish or vice versa.

When the indicator crosses the zero line, traders will evaluate other factors like price action and additional indicators to confirm an entry. Stops are placed below support on long trades and above resistance on short trades.

Divergence

Divergence between the oscillator and price action is another highly effective signal, especially when trading reversal patterns.

Bullish divergence forms when price makes a lower low while the oscillator forms a higher low – indicating buying momentum is increasing even as price falls. This suggests upside momentum is building.

Bearish divergence is the opposite – price posts a higher high while the oscillator forms a lower high. This reflects waning upside momentum, signaling a potential peak.

Traders look to enter a new position in the direction of the divergence after it occurs, using other indicators to confirm.

Signal Line Crossovers

The default accelerator oscillator has upper and lower signal lines set at levels of +0.02 and -0.02. Crossing these signal lines reflects a strong momentum surge in that direction.

A bullish signal occurs when the oscillator crosses up through the upper signal line and a bearish signal when crossing the lower signal line. These signal line crossovers can be used independently or to confirm other trading signals.

Overbought/Oversold Extremes

Monitoring the extreme highs and lows of the oscillator can pinpoint optimal levels to take profits or identify potential reversals.

When the oscillator reaches extremes above +0.20 or below -0.20, it indicates continuation is unlikely. Traders will tighten stops or close a portion of the position as the extreme levels are reached.

The most profitable trades often come after the oscillator reverses from extreme overbought/oversold levels. This reflects a momentum surge that is losing strength as the oscillator turns back toward the mean.

How to Use the Accelerator Oscillator in Your Trading

Now let’s discuss how to effectively implement the accelerator oscillator into your forex trading plan. Follow these tips for maximizing this indicator:

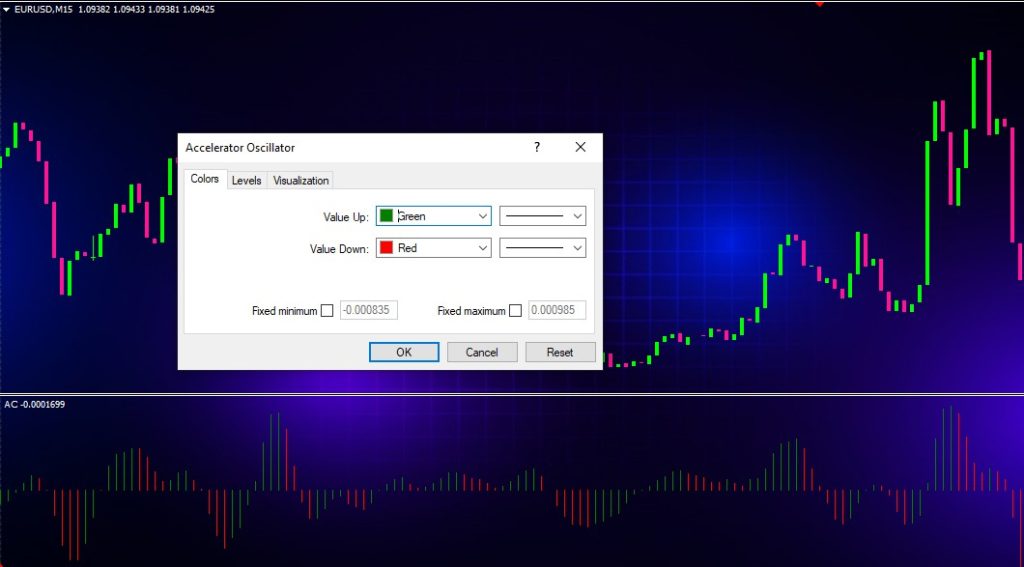

- Use the default 5 and 34 period moving averages – these values have been optimized for forex trading. Don’t attempt to tweak without extensive testing.

- Combine signals with other technical indicators like moving averages to validate and increase profitability. The AC is most effective when used with confirmation.

- Focus on trades in the direction of the major trend. Use a longer term indicator like the 200 period moving average to define the prevailing trend.

- Look for divergence with price extremes. Some of the highest probability trades come from bullish/bearish divergence at major support/resistance levels.

- Trade with the bias of your time frame. Daily chart signals produce the most profitable trades on the daily chart. But use shorter time frames to fine tune entry and exit levels.

- Adjust stops to lock in profits as the market moves in your favor. Trail stops below support on long trades and above resistance on shorts.

Mastering the nuances of the accelerator oscillator takes time and practice. Let’s now examine the pros and cons of this versatile indicator.

Advantages of the Accelerator Oscillator

The accelerator oscillator has some unique benefits that make it a worthwhile addition to forex trading strategies:

- Responsive to changes in momentum – The AC oscillator rapidly reflects shifts in the speed of price movement. This allows traders to identify momentum shifts early before a change in trend occurs.

- Smooths out price action – By utilizing moving averages in its calculation, the indicator filters out short term noise to focus on the bigger picture momentum of the trend.

- Confirms divergence – The AC oscillator is specifically designed to detect divergence with price. This makes it a valuable confirmation tool.

- Flexible for all time frames – The settings of 5 and 34 periods work well for short, medium, and long term time frames. No adjustments are needed.

- Works on all forex pairs – The accelerator oscillator is not limited to specific currency pairs. It can be applied effectively to any actively traded major, minor, or exotic currency.

- Free to use – No proprietary algorithms here. The AC oscillator is freely available on all trading platforms making it accessible to every forex trader.

Limitations of the Accelerator Oscillator

While the accelerator oscillator is a robust indicator for forex trading, it does have some drawbacks to consider:

- Lagging – With moving averages at its core, the AC is by nature a lagging indicator. It will always react after the price trend has started to shift.

- Requires confirmation – For highest accuracy, accelerator oscillator signals should be confirmed with other technical or price action analysis before acting.

- Prone to false signals – Whipsaws above/below the zero line will occur during trading ranges. This can result in unprofitable trades if taken blindly.

- Doesn’t indicate slope – The AC oscillator fluctuates around the zero line. But it doesn’t clearly convey whether momentum is increasing or decreasing.

- No fixed overbought/oversold levels – Unlike the RSI which has set 70/30 levels, the AC oscillator fluctuates too widely to define fixed extremes.

No single indicator will provide perfect signals in forex trading. The value comes from combining the accelerator oscillator with other analysis to confirm profitable trades.

Conclusion

The accelerator oscillator is a valuable momentum indicator that deserves a place in every active forex trader’s toolbox. By revealing shifts in momentum early, the AC oscillator helps traders identify high probability turning points in the market.

To recap, key takeaways for utilizing the accelerator oscillator effectively include:

- Trade in the direction of momentum shifts signaled by zero line crossovers

- Look for bullish/bearish divergence at price extremes

- Use signal line crosses for additional confirmation

- Adjust stops to lock in profits as momentum runs out

- Combine with other technical analysis for highest accuracy

While not perfect, having the ability to gauge momentum and overbought/oversold levels provides a trading edge for forex traders. Master the nuances of the accelerator oscillator and integrate it into your broader trading plan to take your analysis to the next level.