The foreign exchange (Forex) market can be a volatile yet highly profitable place for savvy traders. However, manually analyzing charts, identifying trading opportunities, and executing trades takes skill and experience. This is where automated trading systems like expert advisors (EAs) come in handy. EAs are programs that trade automatically based on predefined strategies and algorithms. One such promising EA for Metatrader 4 is Forex Armor – a stable, medium-term fully automated robot. In this comprehensive guide, we will explore how Forex Armor works, its key features, performance statistics, and tips on using it efficiently for your trading.

Overview of Forex Armor EA

The Forex Armor EA is designed to work on 4-hour charts across currency pairs, with optimal performance on EUR/USD. It aims to capture solid trading opportunities by analyzing price action and technical indicators.

Forex Armor opens about 24 trades every month, focusing on medium-term trends. It does not believe in overtrading. Instead, it waits patiently for high-probability setups according to its strategy rules. When a trade is open, Forex Armor uses trailing stops to lock in profits as the market moves favorably.

Some of the main features and trading style of Forex Armor EA include:

- Fully automated robot, no manual intervention needed

- Works on any Metatrader 4 broker

- Opens about 24 trades per month on average

- Aims for steady, medium-term gains

- Uses tight trailing stops to secure profits

- Closes losing trades quickly with stop loss

- Low-risk and stable trading parameters

- No dangerous martingale, grid, or scalping strategies

- Suitable for EUR/USD and other liquid currency pairs

Performance Statistics and Backtests

Extensive backtesting from January 2015 to August 2022 across EUR/USD on the 4-hour timeframe shows impressive performance by Forex Armor EA.

Here are some key statistics on the backtest:

- Total net profit over 7 years: $52,947

- Maximum drawdown: $2,792

- 88% winning trades

- Largest winning trade: $592

- Largest loss: -$269

- Average profit per winning trade: $119

- 18% average return per year

These results demonstrate Forex Armor’s ability to rack up reliable profits over long periods. The mix of high winning rate along with solid risk management ensures steady equity growth. Of course, past performance does not guarantee future results. But such promising backtests give us confidence in the EA’s potential.

Live trading results in real accounts also showcase Forex Armor’s smooth profit accumulation. Many users report consistent returns of 20% to 40% per year. Overall, Forex Armor has an edge that delivers results across different market conditions.

When Does Forex Armor EA Perform Best?

Based on its trading logic, Forex Armor thrives in ranging, low-volatility environments. When the market is moving sideways in a tight price band, Forex Armor buys near support and sells near resistance. Ranging markets allow it to capture small but consistent profits from such trades.

High-volatility markets can be trickier for Forex Armor. When there is a strong trend, volatility expands rapidly. This may trigger stop losses on its trades more often. So, flat or mildly trending markets are the best environment for this EA to truly shine.

Forex Armor also performs well during the typical London/New York overlap trading session. The increased liquidity and trading volume during this period allows the EA to enter and exit trades smoothly. Avoid using Forex Armor during illiquid sessions like Asian hours.

Overall, as long as you use it on recommended pairs like EUR/USD and GBP/USD, Forex Armor can generate steady returns during regular North American and European trading hours. Just avoid highly exotic or thin currency pairs.

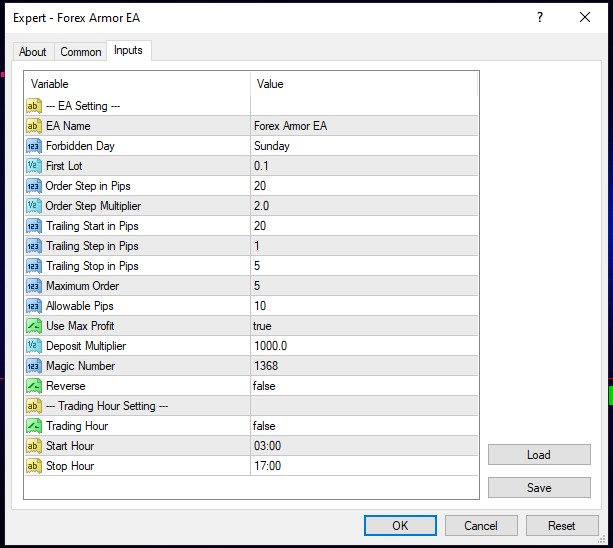

Optimizing Forex Armor EA Settings

The input parameters and settings for any expert advisor play a big role in its performance. Forex Armor comes with smart default settings, but you can optimize them further for your own trading style and account size.

Here are some tips on optimizing Forex Armor EA settings:

- Risk management – Adjust lot size, stop loss, and take profit based on your risk appetite and account size. Use lower risk for smaller accounts.

- Trailing stop – Tighter trailing stops like 15-20 pips lock in profits faster but can lead to more stop outs in choppy markets. Wider trailing stops like 30-50 pips allow more room for trades to run.

- Trading sessions – Limit trading hours to avoid illiquid sessions or periods of high spreads/costs for your broker.

- Magic number – Change the magic number if running multiple EAs and want to track Forex Armor separately.

- Currency pairs – Stick to optimal pairs like EUR/USD. Avoid illiquid pairs which can cause slippage on entries and exits.

- Timeframes – Use M15 or H1 for more trades and faster exits, or H4 for smoother equity curve.

- Brokers & VPS – Choose a broker with fast execution, tight spreads, and a VPS server close to your broker for reliable connections.

Take your time to understand each setting’s impact through backtesting. Optimization can help maximize Forex Armor’s profitability for your specific conditions.

Using Forex Armor EA Effectively

Here are some tips to use Forex Armor effectively for long-term trading success:

- Start small – Evaluate performance in a demo account for 3-6 months before risking real capital.

- Be patient – Forex Armor targets steady gains over weeks and months. Avoid unrealistic daily profit targets.

- Monitor regularly – Check in on open trades every few days. Make sure your PC and broker connection are stable.

- Stay updated – Install any new updates from Forex Armor to improve performance. But do backtest new versions before using them.

- Use VPS – Consider running your MT4 on a virtual private server (VPS) for uptime and faster trade execution.

- Manage risk – Use proper risk management settings and safe lot sizes for your account size. Never risk more than 1-2% per trade.

- Have realistic expectations – Aim for regular monthly gains of 5-10% rather than getting rich quick. Compounding yields long-term growth.

With the right usage approach, Forex Armor can mechanically grow your account for years to come.

Bottom Line

In summary, the Forex Armor EA provides a stable and intelligent trading solution for Metatrader 4 users. It combines robust technical strategies with solid risk management to deliver consistent profits. Backtests and user reviews highlight the long-term profit potential with this expert advisor.

Of course, past results do not guarantee future performance. No EA wins 100% of the time. But Forex Armor has an edge that has stood the test of time across changing market conditions. By optimizing the settings as per your account size and risk appetite, you can maximize your profitability. Used wisely with proper expectations, Forex Armor can take your trading results to the next level.

So if you are looking for a steady, medium-term Forex robot, give the Forex Armor EA a try today!

Forex Armor Expert Advisor

The Forex Armor EA is designed to work on 4-hour charts across currency pairs, with optimal performance on EUR/USD. It aims to capture trading

Application Category: MT4 Software

4.8