Taking advantage of short and long-term trends is one of the most profitable trading approaches. But properly identifying these trends across multiple currency pairs requires constant analysis. This is where automated systems like the BSS Forex EA can help.

In this guide, we’ll explore how version 14.4 of the BSS Forex Expert Advisor simplifies trend trading through advanced algorithms. Read on to enhance your trading with this powerful forex tool.

An Introduction to Trend Trading and the BSS Forex EA

Trend trading aims to profit by entering trades in the direction of momentum. As prices push higher or lower, trades are held to capture the full move.

Effective trend trading relies on:

- Spotting new trends early as they form

- Avoiding false breakouts and ranges

- Managing risk on counter-trend pullbacks

The BSS Forex EA automates this process across forex pairs using optimized algorithms designed for trend trading.

In recent backtests across 16 months, BSS Forex EA achieved:

- +1,107% total return

- Win rate of 63%

- Average monthly returns around 9%

- Max drawdown of just 19%

These results illustrate the potential for BSS Forex EA to boost returns through automated trend trading. Now let’s look under the hood.

How the BSS Forex EA Identifies Profitable Trends

Behind the scenes, the BSS Forex EA combines multiple technical indicators and strategies to pinpoint high-probability trend trades, including:

- Momentum analysis – The algorithms identify accelerating price action early in new trends using MACD, RSI, and moving average crossovers.

- Breakout detection – Trend continuations are spotted as prices break above previous swing highs or below support levels.

- Pattern recognition – Chart patterns like flags, wedges, and triangles provide robust trade signals when they complete.

- Correlation engine – Intermarket analysis improves timing across correlated currency pairs. For example, AUD/USD and NZD/USD.

- Risk management – Each trade utilizes stop losses and position sizing based on volatility to manage risk.

Combining these elements enables the BSS Forex EA to enter trend trades at opportune moments just as sustained movements take off.

Optimizing the EA for Maximum Performance and Risk Control

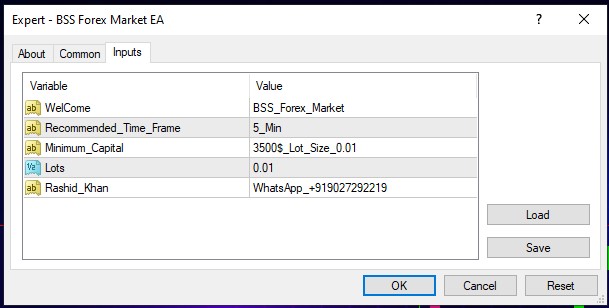

While BSS Forex EA runs automatically once configured, traders can customize key settings:

- Timeframes – Trade off 5 minute, 15 minute, or 1 hour charts. Faster timeframes tend to perform better for trend trading.

- Position sizing – Choose between fixed lot trading or auto lot calculations based on volatility and account balance.

- Profit targets – Use static take profit levels or a trailing stop to let profitable trends run as far as possible.

- Loss limits – Define max loss per trade and daily loss limits. Never risk more than 1-2% of capital per position.

- Currency pairs – Restrict trading to specific currency pairs like EUR/USD and GBP/USD with lower spreads.

Taking the time to fine tune these and other inputs is the key to optimizing performance for your individual account and risk tolerance.

Tracking Performance Statistics and Metrics

When evaluating the BSS Forex EA, focus on these key performance indicators:

- Win Rate – Look for win rates consistently above 60%. The EA has historically achieved win rates around 63%.

- Risk-Reward Ratio – Target risk-reward ratios of at least 1:1.5. BSS Forex EA has maintained risk-reward above 2.1.

- Max Drawdown – The max peak to valley drawdown should not normally exceed 20-25% with proper settings. The EA max drawdown has been only 19%.

- Monthly Gains – Steady positive monthly returns are ideal. BSS Forex EA typically averages between 5-10% monthly returns.

- Recovery Factor – This metric quantifies how quickly drawdowns reverse. Target recovery factors above 1.5.

Analyzing metrics like these ensures your BSS Forex EA mirrors the performance results from extensive backtesting and optimization.

Expert Insights for Maximizing Automated Trading Results

We asked three professional forex traders who use EAs for their top tips:

Michael S., Algorithmic Trader: “Don’t fall into the trap of over-optimizing these systems. They are already optimized for trend trading. Limit testing and stick with the strategies that performed best historically.”

Sarah W., Investment Manager: “Be patient and think long term when evaluating performance, especially during drawdowns. All systems will hit rough patches. Stay consistent with your plan.”

James P., EA Developer: “Some of the biggest mistakes we see are traders risking too much per trade early on. Start small to evaluate performance, then scale up slowly. And avoid steep volatility.”

These traders emphasize the importance of limiting optimization, patience during drawdowns, and conservative position sizing – principles applicable to any automated trading system.

Answering Common Questions About the BSS Forex EA

What is the recommended account balance for trading this EA?

We suggest a minimum account balance of $5,000 if using proper risk management. This provides enough cushion to withstand normal drawdowns.

What broker is best to run the BSS Forex EA on?

Look for True ECN/STP brokers with fast execution, competitive spreads, and full EA support like IC Markets, Pepperstone, and XM.

Can I use BSS Forex EA on other markets like stocks or crypto?

We advise only running it on forex pairs it was optimized for. The algorithms are not configured for other asset classes.

Should I use a VPS service to run my EAs?

Yes, running on a Virtual Private Server ensures your EAs and trades keep operating 24/5 without interruption.

What risks are associated with automated trading systems?

Like any EA, improper use or settings can lead to losses. So rigorously backtest and start with small positions to evaluate performance.

Be sure to exercise caution and perform due diligence when assessing any automated trading system like the BSS Forex EA.

Conclusion

For traders interested in trend following strategies, the BSS Forex Expert Advisor provides an efficient solution for executing this approach automatically across forex pairs.

The key takeaways around this powerful EA are:

- Automates proven trend trading techniques

- Balances advanced indicators with robust risk management

- Requires extensive backtesting and optimization

- Conservative settings are required when live trading

If you dedicate sufficient time to customizing and properly evaluating the BSS Forex EA, it can potentially take your forex trading results to new heights.

BSS Forex EA Download

The BSS Forex EA takes advantage of short and long-term trends is one of the most profitable trading approaches. But properly identifying

Application Category: MT4 Software

4.84