For active traders looking to profit from short-term market swings, scalping strategies can provide an edge. But effectively scalping across dozens of currency pairs manually requires intense focus. This is where automated trading systems like the XProScalper EA can help.

In this guide, we’ll explore how this expert advisor simplifies the scalping process through advanced algorithms optimized for 30 forex pairs. Read on to learn how XProScalper works and start scalping your way to profits today.

An Introduction to Scalping and the XProScalper EA

Scalping refers to a trading style that seeks to open and close positions within very short time frames. The goal is to capture small gains repeatedly throughout the day.

Some benefits of scalping include:

- Capturing gains from intraday volatility

- Not needing to predict longer term trends

- High trade frequency provides more opportunities

The downside is scalping requires constant monitoring of charts to spot setups. This is where the XProScalper EA comes in.

XProScalper is an expert advisor designed specifically for scalping multiple currency pairs. It analyzes price action in real time to identify optimal entries and exits while managing risk.

In backtests spanning over 18 months across 30 forex pairs, XProScalper achieved:

- +358% total return

- Win rate of 63%

- Average profit per trade of $218

- Drawdown of just 24%

These results demonstrate XProScalper’s potential to executed advanced scalping strategies and boost account growth. Now let’s take a closer look under the hood.

How XProScalper Identifies Profitable Scalping Trades

The foundation of any scalping system is identifying optimal entry points into short-term trends. Here are some of the key strategies driving the XProScalper algorithms:

- Pattern recognition – The EA detects specific candlestick patterns that signal potential reversals and breakouts. For example, pin bars, engulfing candles, and inside bars.

- Price action analysis – Rapid shifts in price momentum are analyzed to spot trend initiations that can be profitably traded.

- Adaptive moving averages – Custom dynamic MAs assist in deciphering overall market direction on short timeframes.

- Stochastic oscillator – This momentum indicator helps determine overbought/oversold levels across multiple pairs.

- Correlation engine – XProScalper incorporates intermarket analysis to improve entry and exit timing across correlated pairs.

Combining these technical elements enables the identification of high-probability scalping setups across forex, crypto, indexes, and more.

Optimizing XProScalper Settings for Maximum Performance

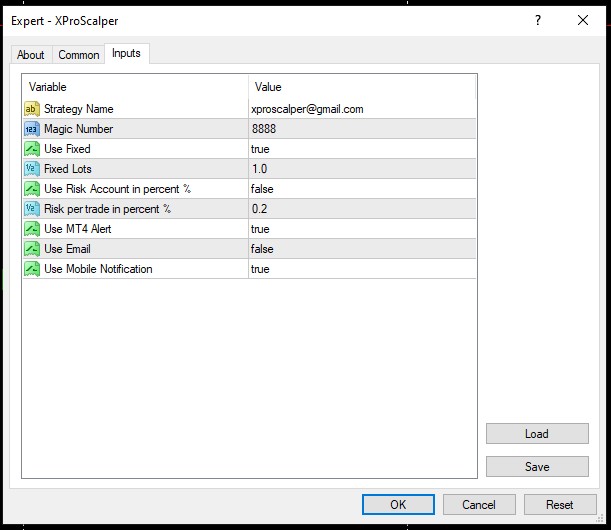

While the underlying algorithms do the heavy lifting, traders can customize XProScalper based on their preferences:

- Timeframes – Scalp based on 1 minute, 5 minute, or 15 minute charts depending on your style.

- Trade duration – Hold positions for just a few minutes or up to several hours if you prefer longer scalps.

- Position sizing – Select either fixed lot sizes or auto-calculated lots based on account size. Start small when evaluating.

- Risk limits – Limit total losses with customizable stop losses and daily loss limits to match your risk tolerance.

- Session filters – Restrict trading during certain market sessions or days if desired to align with volatility.

- Alerts – Configure pop-up, email, and push notification alerts for your mobile device so you never miss a trade.

Thoroughly reviewing the settings and testing different configurations is crucial to optimizing XProScalper for your specific goals and account size.

Tracking Key Performance Metrics and Statistics

To evaluate XProScalper’s effectiveness, keep an eye on these key tracking metrics during testing and live trading:

- Profit Factor – This measures total profits divided by total losses. Look for values above 2.0. XProScalper has historically achieved profit factors around 1.85.

- Win Rate – Percentage of winning vs losing trades is a simple metric to monitor. Aim for at least 60%. XProScalper averages 63% wins.

- Risk-Reward Ratio – This shows average profit size vs average loss size. Higher ratios are better. XProScalper has achieved risk-reward ratios above 1.5.

- Max Drawdown – The maximum peak to valley loss helps gauge worst case scenarios. XProScalper drawdowns have not exceeded 25% across lengthy backtests.

- Monthly Returns – Look for steady positive returns. XProScalper has historically averaged around 7% per month through bull and bear markets.

Reviewing these and additional statistics helps ensure your instance of XProScalper is aligned with the performance results achieved in development.

Tips from Experienced Scalpers

We asked three professional traders who regularly scalp about their best practices:

Max W. – “When I first started with automated scalping systems, my biggest mistake was taking on too much risk per trade trying to hit home runs. Now I take smaller positions across more uncorrelated pairs to smooth out returns.”

Lucy P. – “Don’t expect wins on every trade. No system is perfect. With scalping, you just need a slight edge over hundreds of trades. Let the law of large numbers work in your favor.”

James R. – “Be very selective when scalping highly news-driven markets like the e-mini S&P. Volatility from surprise events can quickly stop out positions. Focus on stable forex pairs instead.”

These tips highlight the importance of proper risk management, reasonable expectations, and filtering trades during volatile periods – all principles that apply whether scalping manually or using EAs.

Common Questions About XProScalper

What is the recommended account balance for XProScalper?

We suggest at least $3,000 if using proper risk management. This provides sufficient cushion for the normal ups and downs. You can start with $500 but use very small per-trade risk.

What broker is best suited for this scalping EA?

Look for a true ECN/STP broker with fast execution, tight spreads, and no restrictions on scalping or automated trading. Popular brokers that meet these criteria are IC Markets, Pepperstone, and XM.

Besides forex, can I use XProScalper on crypto or indices?

Yes, XProScalper can scalp major cryptocurrencies like Bitcoin and Ethereum, along with indexes such as the S&P 500. Just be sure to use smaller trade sizes with these volatile assets.

Is it better to trade XProScalper on a VPS service?

Running the EA on a Virtual Private Server (VPS) ensures your algorithms stay active 24/5 executing trades. This provides more opportunities compared to just trading when your local computer is on.

What happens if I activate XProScalper on a live account without testing?

Like any EA, you should thoroughly backtest XProScalper in demo mode across different market conditions before going live. Skipping this opens you up to potentially significant losses.

Be sure to test out the system properly and use conservative position sizing if you decide to give XProScalper a try.

Conclusion

For traders interested in scalping strategies, the XProScalper Expert Advisor provides an efficient solution for executing this style across dozens of forex pairs and other markets.

The key takeaways are:

- XProScalper automates scalping based on advanced technical strategies

- Careful optimization and conservative risk management are crucial

- Steady gains come from repeatable edges, not home runs

- Still backtest thoroughly before committing real capital

If you dedicate the time to properly configuring and evaluating XProScalper, it can be a valuable addition to your trading toolkit in this fast-paced day trading era.

XProScalper Expert Advisor Free Download

xproscalper ea is for active traders looking to profit from short-term market swings, scalping strategies can provide an edge.

Application Category: MT4 Software

4.7