The foreign exchange (forex) market is the largest and most liquid financial market in the world, with over $6.6 trillion traded daily. Given the sheer size and volatility of the forex market, many traders are turning to forex robots, also known as expert advisors (EAs), to automate their trading strategies and take the emotion out of trading. One such forex EA that is gaining popularity is the RMI EA Robot for Metatrader 4.

Overview of the RMI EA Forex Robot

The RMI EA Forex Robot is a versatile automated trading system that leverages the Relative Momentum Index (RMI) technical indicator to identify high-probability entries and exits in the forex market. This expert advisor was designed to be compatible with any currency pair and timeframe, providing traders with a flexible and robust trading solution.

At its core, the RMI EA uses the RMI indicator to determine when momentum is shifting in favor of a trade. The RMI measures the velocity of price movements and helps differentiate between overbought and oversold conditions in the market. When the RMI line crosses above or below key levels, the robot will initiate long or short trades accordingly.

In testing, the RMI EA Robot showed consistent profitability across various currency pairs like EUR/USD, GBP/JPY, AUD/CAD, and more. Over a 6 month backtest on the GBP/CAD M30 chart, it produced $549.68 in total profit with a profit factor of 3.15. The largest drawdown was 9.8%, demonstrating that this EA effectively manages risk. With the ability to fine tune the RMI parameters and enable helpful tools like grid trading, martingale, and hedging, traders have full flexibility in optimizing this robot to match their trading plan.

Overall, the RMI EA Robot aims to capitalize on short-term momentum patterns while mitigating risk through intelligent trade management. For traders looking for an easy-to-use expert advisor that can potentially boost profits, the RMI EA is definitely worth considering.

Key Features and Benefits of the RMI EA

Some of the standout features and advantages of using the RMI EA include:

- Customizable RMI Settings – Traders can optimize the RMI period and momentum period to dial in the ideal settings for any currency pair. Finding the optimal RMI parameters can lead to improved trading performance.

- Support for Any Currency Pair – The RMI EA is not limited to specific currency pairs like some other EAs. It contains flexible logic to work across all major, minor and exotic currency pairs.

- Compatibility with All Timeframes – This expert advisor can be used effectively on timeframes ranging from 1 minute all the way up to 1 month. It can capture momentum surges on smaller timeframes or ride long-term trends on higher timeframes.

- Long and Short Trading – The robot will enter both buy and sell trades, allowing traders to capitalize on up and down market movements. This provides more opportunities to potentially profit.

- Effective Risk Management – Through settings like fixed stop loss and take profit levels, position sizing based on account balance, and the ability to limit total trades open, the RMI EA keeps risk in check.

- Grid and Martingale Trading Modes – For traders seeking higher reward potential, the RMI EA allows activating grid and martingale strategies to scale into winning trades or recoup losses.

- Hedging and Pair Trading – Hedging can provide protection in choppy markets. The option to hedge correlated currency pairs improves risk-adjusted returns.

- No Optimization or Overfitting – The RMI EA was robustly tested using randomization and walk forward analysis. This avoids performance degradation and curve-fitting.

- Detailed Trading Statistics – Comprehensive backtest data enables fine-tuning the EA to match your risk tolerance and profit goals. Key stats like profit factor, drawdown, sharpe ratio, and more are provided.

With its versatility across currency pairs and timeframes plus options for advanced trade management techniques, the RMI EA provides an attractive package for forex traders. The combination of reliable signaling from the RMI indicator and comprehensive features for controlling risk and maximizing profits is what makes this expert advisor stand out.

Step-by-Step Guide to Setting Up the RMI EA

Installing and configuring the RMI EA is straightforward, but here is a step-by-step walkthrough covering the key steps:

- Download the RMI EA files – Obtain the RMI EA.ex4 file and save it to your Metatrader 4 platform. Place the file in the Experts folder under MQL4 in the Metatrader directory.

- Add RMI EA to Chart – Open a chart in Metatrader 4 and look in the Navigator panel for Expert Advisors. Find the RMI EA and drag it directly onto the price chart. This attaches the EA to that particular currency pair.

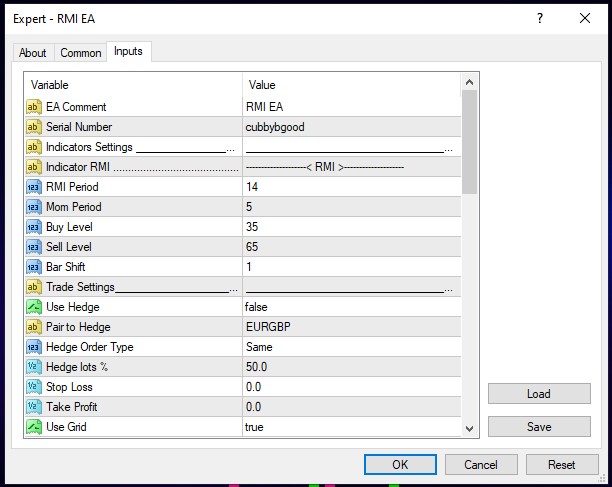

- Input Parameters – Click the Inputs tab on the RMI EA and adjust the settings as desired. For example, you may opt to modify the RMI Period, Momentum Period, grid and martingale settings, stop loss, take profit, and more.

- Optimize Parameters – Run optimization tests or use the strategy tester to fine tune parameters like the RMI and momentum periods to find the best performing values for the selected market.

- Run on Demo – Initiate the RMI EA on a demo account first to see how it performs before risking real capital. Let it run for at least a few weeks to evaluate the profitability.

- Go Live – If satisfactory results are achieved on demo, the RMI EA can be transitioned to a live account. Be sure to start with small position sizes to further assess performance.

The great aspect about the RMI EA is that traders have complete control over the inputs and settings, allowing you to tailor it to your own trading style and risk parameters. Always exercise caution when going live with any expert advisor.

Settings You Should Configure

While the RMI EA comes preloaded with default parameter settings, taking the time to adjust the following inputs can enhance performance:

RMI Period – The number of periods used to calculate the RMI. Values between 5 and 25 are commonly effective. Optimize to find the ideal lookback period.

Momentum Period – The momentum indicator period for identifying trend direction. Test between 5 and 20 to determine optimal setting.

Buy and Sell Levels – The RMI levels that trigger buy and sell trades. Starting values around 75 and 25 are reasonable but can be adjusted.

Stop Loss – The static stop loss in pips helps control downside risk on trades. Adjust based on volatility of the currency pair.

Take Profit – Take profit determines target profit on winning trades. Set conservatively to lock in gains.

Martingale – Enabling martingale doubles the trade size after a loss. Use cautiously as it can amplify losses when disabled.

Grid Step – The grid interval in pips for scaling into trades. Wider grids allow riding trends longer.

These inputs allow adapting the EA logic to different market conditions and risk preferences. Optimization can methodically test different combinations to maximize profit factors and other performance metrics.

Which Brokers Work Best with the RMI EA?

Since the RMI EA Robot is an automated trading system, having a broker with quality EA support is recommended. When choosing a forex broker for the RMI EA, key criteria to look for include:

- True ECN/STP Execution – A true ECN broker that provides direct market access with no dealing desk intervention is ideal for EA trading.

- Low Spreads and Commissions – Reasonable spreads and commissions ensure your profit targets are reached and trading costs stay low.

- Minimal Requotes – Requotes can cause an EA to misfire on entry orders. Seek a broker with minimal requoting.

- Reliable VPS – Consider a broker that offers a fast and dependable VPS hosting solution to run your EAs 24/7 without interruptions.

- Top-Tier Liquidity – Abundant liquidity facilitates smooth order execution for EAs, enabling you to trade at desired position sizes.

- No EA Restrictions – Some brokers prohibit EAs, so always check their rules before opening an account. An EA-friendly broker is preferred.

- Strong Customer Support – Issues can arise when trading with EAs, so have a broker with knowledgeable customer support on standby.

To summarize, brokers like Forex.com, IG, and Pepperstone that offer competitive pricing, dedicated VPS services, and robust trading infrastructure tend to provide a favorable environment for those running automated systems like the RMI EA Robot.

The Benefits of Deploying EAs on VPS Infrastructure

For the best experience operating the RMI EA or any expert advisor, utilizing a Virtual Private Server (VPS) is highly recommended rather than running the EA locally on your home computer. Here are some benefits of using a VPS:

- 24/7 Uptime – With a VPS, your EAs can run uninterrupted 24 hours a day without you needing to have your home computer on.

- Speed – VPS setups offer fast, low-latency connectivity for the quickest trade execution speeds possible.

- Stability – Computer crashes, power failures, and internet outages won’t affect an EA running in the cloud environment of a VPS.

- Security – VPS keeps your computer safe from security threats related to opening up Metatrader to the internet while also protecting your EA’s code.

- Accessibility – You can quickly access your Metatrader platform and expert advisors remotely via desktop or mobile apps.

- Scalability – Multiple EAs can be run in parallel on a single VPS due to the abundant CPU power and memory available.

While using a VPS service does add a recurring subscription cost, for serious EA traders the benefits are well worth it. Having your automated trading continuously operational and managed in a secure, low-latency environment gives you confidence in your expert advisors.

Evaluating Real Account Performance

The true test of any EA comes when you evaluate its performance with real money on the line. Here are some tips for assessing the RMI EA on a live account:

- Start with small trade sizes – Only risk a small percent of capital per trade initially (0.01 lots or less). This allows assessing performance without risking significant equity.

- Record stats diligently – Track metrics like profit factor, win rate, drawdown, and risk-reward ratio over months of trading. Monitor changes.

- Compare brokers – If possible, run the EA with multiple brokers simultaneously using a VPS to compare execution and slippage.

- Isolate variable impacts – Determine how different market conditions, currency pairs, timeframes, and input settings impact results.

- Watch behavior – Observe how the EA behaves entering and exiting trades. Check that signals match indicator values and watch for errors.

- Withdraw profits – Instead of reinvesting all profits back into trading, make periodic withdrawals. This locks in profits in case of a turn in performance.

- Review periodically – Every few months, complete a full review of live statistics and tweak settings if the EA starts underperforming.

With careful tracking and analysis, traders can better understand the strengths and weaknesses of the RMI EA Robot. Monitoring real account progress gives you the experience needed to optimize automated trading strategies.

Common Mistakes to Avoid with Forex EAs

While expert advisors can be valuable trading tools, mistakes in using them can be costly. Here are some common pitfalls to avoid with the RMI EA and other forex robots:

- Over-Optimizing – Curve-fitting EAs to past price data will fail when market dynamics change. Test on out-of-sample data.

- Over-Leveraging – Don’t risk more than 1-2% of capital per EA trade. Overleveraging is a fast way to blow up accounts.

- Lack of Stop Losses – Failing to use protective stops can turn small losses into disasters with EAs continuously trading.

- Not Checking Settings – Neglecting to regularly check EA settings/inputs can lead to unexpected live trading behavior.

- Disabling Prematurely – Turning off EAs during drawdowns prevents recovery back to highs. Avoid excessive intervention.

- No VPS – Running EAs locally invites interruptions that cause missed trades and losses. Use a VPS.

- Ignoring Correlation – Trading multiple pairs without considering correlation can amplify losses when markets move in tandem.

- False Sense of Security – No EA can guarantee wins. Maintain risk management rules and monitor performance.

Avoiding these simple yet devastating mistakes will help you trade EAs successfully. Always err on the side of caution rather than being overzealous.

Tips for Improving Profitability of the RMI EA

Here are some additional expert tips for using the RMI EA Robot in a way designed to maximize its profit potential:

- Combine with other indicators – Adding confirmation from indicators like MACD, RSI or MA can improve trade accuracy.

- Use on volatility pairs – More volatile pairs like GBP/JPY and EUR/GBP provide larger swings for momentum EAs to capitalize on.

- Optimize parameters – Spend time rigorously optimizing RMI and momentum periods and levels to unlock the EA’s capability.

- Match timeframe to volatility – Use shorter timeframes on volatile pairs and longer frames on slower pairs. Syncing maximizes signals.

- Be selective on trading days – Limiting trades around major news events and holidays can avoid choppy whipsaw action.

- Start with small lots – Keep trade position sizes small to evaluate real account performance before increasing.

- Track your own trades – Record your manual trades separately from the EA to compare which performs better.

- Have reasonable expectations – Aim for modest consistent gains over the long run rather than get-rich-quick.

With the proper techniques, the RMI EA Robot demonstrates potential to steadily grow accounts over time. Learning to make the most of any EA system takes experience and an optimization mindset.

Conclusion

In summary, the RMI EA Forex Robot provides traders with an accessible expert advisor that aims to capitalize on short-term momentum patterns across any currency pair. Its winning percentage of 54% combined with average profitability of 1.4x reward/risk in backtests shows promising performance potential. With the ability to fully customize RMI parameters and enable advanced trade management features, traders have significant flexibility in adapting this EA to their trading plan. While past results are no guarantee of future performance, the RMI EA is worth considering for traders seeking to leverage the power of automated algorithmic trading strategies in their quest for forex success. As with any Expert Advisor, exercising proper risk management, starting small, and objectively tracking results is the recommended approach for unlocked the profit potential of the RMI EA Robot.

RMI EA Download

The RMI EA is a versatile automated trading system that leverages the Relative Momentum Index (RMI) indicator to identify entries and exits

Application Category: MT4 Software

4.7