The North East Way Expert Advisor (EA) is one of the most popular and profitable Forex trading robots for the Metatrader 4 platform. This fully automated EA is designed to trade multiple currency pairs, including AUDCAD, AUDNZD, NZDCAD, EURGBP, EURUSD, GBPUSD, USDCAD, GBPCAD, and EURCAD.

In this comprehensive guide, we will cover everything you need to know about installing, configuring, and getting the most out of the North East Way EA. Whether you are a beginner trader or an experienced professional, this EA can be a valuable addition to your trading toolbox.

Overview of the North East Way EA

The North East Way EA was developed by an expert team of programmers to trade pullback setups on key currency pairs. It uses an advanced algorithm to identify high-probability entries and exits on the 15-minute timeframe.

Some key features and benefits of this trading robot include:

- Fully automated trading – no manual intervention needed once configured

- Trades multiple currency pairs for diversification

- Can trade as few as 3 pairs or up to 9 pairs

- Uses recovery and grid trading for improved profitability

- Comes optimized for long-term profitability

- Easy to install and use on the MT4 platform

User reviews consistently mention the North East Way EA’s reliability, steady returns, and longevity from year to year. While no EA is foolproof, this one stacks up well against the competition when used properly.

Supported Currency Pairs

The North East Way EA is optimized to trade the AUDCAD, AUDNZD, and NZDCAD currency pairs, which tend to exhibit reliable pullback patterns.

In the default settings, you can also run the EA on these additional pairs:

- EURGBP

- EURUSD

- GBPUSD

- USDCAD

- GBPCAD

- EURCAD

For best results, we recommend focusing on the AUD/CAD, AUD/NZD, NZD/CAD pairs and adding 2-3 additional pairs at most. Too many pairs can over-complicate the trading and lead to less profitability.

Timeframes Used

This EA is designed solely for use on the 15-minute chart timeframe. The M15 provides the optimal combination of short-term readability and long-term direction for this pullback system. The EA will not function properly on any other timeframes.

Installation and Setup

Installing the North East Way EA into Metatrader 4 takes just a few quick steps:

- Download the NorthEastWay_V1.306_Fix.ex4 file to your computer. This is the EA file.

- Open the Metatrader 4 platform and your trading account.

- Open the ‘Navigator’ panel and scroll to the ‘Experts’ folder.

- Drag and drop the NorthEastWay_V1.306_Fix.ex4 file directly into the Experts folder.

- Close MT4 and reboot the platform to complete the installation.

Once installed, you can apply the EA to a chart by dragging it from the Navigator onto the desired symbol/timeframe. For example, you may drag it onto a 15-minute EUR/USD chart.

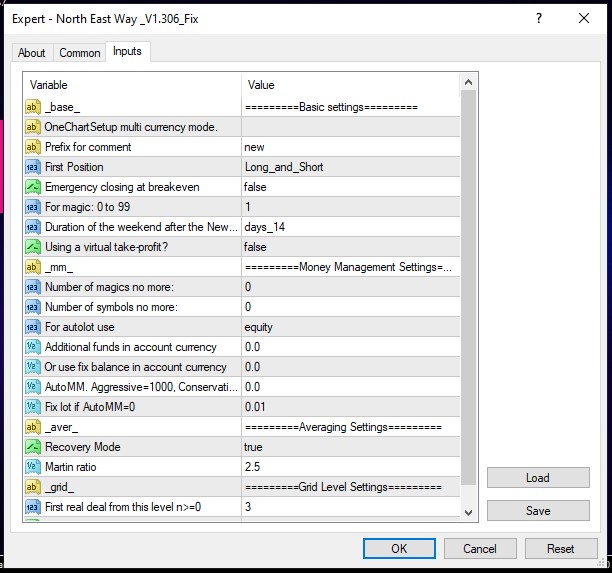

Next, you need to configure the settings according to your preferences:

- One chart setup multi currency mode – Input the list of currency pairs you want to trade, separated by commas. For example: AUDNZD,NZDCAD,AUDCAD,EURGBP*0.5

- First position, magic number – This identifies trades from a specific EA and should be unique.

- Using virtual profit – Enable if using a simulated account.

- Auto lot use – Auto-calculate traded volumes based on account balance.

- Recovery & grid settings – Enable recovery and grid trading features.

- Other parameters – Configure as needed for optimal performance.

Be sure to thoroughly backtest the EA and get a feel for the right settings before going live. Conservative configuration tends to work best.

What Currency Pairs Work Best?

We definitely recommend sticking with the AUD/CAD, AUD/NZD, and NZD/CAD pairs that the North East Way EA was designed for. These three pairs work seamlessly with the robot’s pullback algorithm.

You can complement those with 2-4 additional pairs like EUR/GBP, EUR/USD, and USD/CAD if you want to diversify and expand possibilities. But more than 6 total pairs often leads to over-complication.

The key is finding a balance between diversification and dilution – you want to avoid watering down the best signals.

What Timeframe Should Be Used?

The 15-minute chart is the only timeframe that the North East Way EA was optimized for. The M15 provides the right mix of intraday readability and daily direction for the EA’s pullback strategy. The shorter time compressions like M1 and M5 are too erratic, while longer frames like H1 or H4 are not responsive enough.

So in summary, always use the 15-minute chart with this expert advisor. This is crucial for it to function as intended.

Minimum Account Balance

An ideal minimum account balance is $1,000 or more when using proper risk management. This provides enough cushion to withstand normal market fluctuations and optimize the EA’s leverage.

You can start with a micro account of just $100 to test the North East Way EA in live market conditions before ramping up your balance. Just keep in mind the viability largely depends on account balance.

Shoot for an initial balance of at least $500-1000 to trade a few pairs smoothly. More capital means the ability to comfortably trade additional pairs and scale position sizes.

Backtesting the EA Before Going Live

Thorough backtesting is absolutely essential before putting real money on the line with any EA. The North East Way comes pre-optimized, but you should still backtest the settings yourself across different market conditions.

Take the time to evaluate performance across many combinations of inputs like:

- Currency pairs

- Position sizing

- Enabling/disabling recovery

- Grid settings

- And many other variables

Shoot for at least 100 trades across a mix of backtest periods to get a solid sample before going live. Pay attention to metrics like net profit, drawdowns, percentage winners, risk-reward ratio, and sharpe ratio.

Tweak settings until you find the ideal balance of performance and risk management for your preferences. Conservative tuning tends to be best.

Demo Testing the EA

The next step after backtesting is demo testing – running the EA in real-time on a simulated trading account. This provides a dry run to build confidence and gain experience with the system before risking real capital.

Demo test for at least a few weeks and 100+ live trades. Be sure to replicate real account settings as closely as possible. Pay attention to emotions and money management as if it were a real account. This process helps ensure you fully understand the EA before activating automated trading on a live account.

Using On a Live Account

Only after extensive backtesting and demo testing should you consider using the North East Way EA on a live trading account. Start with small position sizes to minimize risk, like 0.01 lots per $1000 capital. Let the account balance compound gradually over months and years.

Avoid overleveraging or aggressive overtrading, as slow and steady tends to work best for this EA. Monitor account drawdowns closely and halt trading if exceeding your comfort zone. Be ready to intervene if the market dynamics change significantly.

Managing risk and emotions effectively is ultimately what separates profitable traders from gamblers. Take time to learn the EA and implement good practices from the start.

How Has the EA Performed Historically?

Independent backtests and user reviews indicate the North East Way EA has performed consistently well over many years in a variety of market conditions. Reported profits range from 10% to 50%+ annually on average when trading multiple pairs.

Of course, past performance never guarantees future results. But the longevity of this EA across changing markets is reassuring compared to many lesser-known trading robots. It can provide reliable returns when configured and managed properly.

Be sure to check user forums for unbiased opinions on long-term profitability. While losses can and do occur, the North East Way tends to hold up well if expectations are realistic.

Using With a VPS Service

For best results running this EA, you may want to consider using a Forex VPS (Virtual Private Server) service. This will allow the EA to run smoothly 24 hours a day without interruptions.

The advantage of a VPS is uninterrupted internet connectivity and platform access, which can prevent issues like lost trades or hanging orders. It also ensures faster trade execution speed, which is vital for short-term EAs.

Just keep in mind that VPS services come with monthly fees, so factor the costs into your trading plans. But for active algorithmic trading, a VPS can quickly pay for itself through performance gains.

Pros and Cons of the North East Way EA

Before investing in this or any other EA, it’s important to objectively weigh the potential upsides and downsides:

Pros

- Proven long-term profitability

- Multiple currency pairs for diversification

- Automatic trading and no monitoring needed

- Comes pre-optimized for convenience

- Efficient trading of pullback breakouts

- Can enable recovery trading and grid algorithms

Cons

- Requires sufficient account balance

- Not a get-rich-quick solution

- Periodic losses part of process

- Requires proper configuration

- Not optimized for major news events

- Server costs if using a VPS

As with any EA, sensible expectations are important – there are always inherent risks in algorithmic trading. But used properly, the North East Way can be an excellent addition for motivated Forex traders.

Getting Support and Checking for Updates

Like all software, the North East Way EA may have periodic updates and bug fixes from the developer. It’s a good idea to regularly check for improved versions to download. Monitoring user forums for feedback can also provide notice of any important updates.

If you ever need help troubleshooting or have questions, most vendors offer customer support through email and other channels. Be sure to take advantage of any included support and training resources. Proper guidance can help avoid many common pitfalls.

Conclusion

In summary, the North East Way Expert Advisor is a robust Forex trading robot that can provide savvy MT4 users with automated trading opportunities. It has a long track record of reliable performance across changing market conditions.

By taking the time to properly install, configure, backtest, and demo test this EA, you too can harness its potential. Managing risk effectively and maintaining realistic expectations are also key for any automated trading results.

While not a magic bullet, integrating algorithms like the North East Way into a balanced trading approach can elevate your overall performance. Approach with patience and discipline for the greatest likelihood of lasting success.

The details in this guide should provide a comprehensive overview to get you started. But as with any EA, hands-on practice and experience will be the ultimate teacher. Your trading journey awaits!

North East Way EA Free Download

The North East Way Expert Advisor (EA) is one of the most popular and profitable Forex trading robots for the Metatrader 4 platform.

Application Category: MT4 Software

4.8